Our monthly newsletter endeavours to give you insights in to changes and trends we are seeing in the market or industry.

Tabak Newsletter

Happy New Year to all our buyers – is this the year you will purchase a business? This month’s update is taken directly from a recent Tony Alexander (independent economist) newsletter and speaks strongly to what businesses can expect to experience in 2026.

Credit to Tony Alexander and link to this newsletter is https://www.tonyalexander.nz/wp-content/uploads/Tonys-View-8-January-2026.pdf

Action and Preparation

Happy New Year everyone and welcome to a 12-month period which is highly likely to be better in terms of economic growth, job gains, and business profitability than was the case for 2025. There won’t be a boom, but there will be a good opportunity to do the two important things requiring attention when the pace of growth picks up.

First, make sure you secure the key resources you need to take advantage of higher customer demands. That means focussing on staff retention, training, and then recruitment, making sure supply chains for materials are secure, and investing in the right property and equipment in the right locations to be able to optimally take advantage of higher customer flows.

Second, get ready for the next recession. Economies move in cycles and as growth picks up inflationary pressures rise, interest rates rise, and the currency usually goes up as well. Vulnerabilities grow to a shock and history tells us we cannot pick what that shock will be, when it will occur, and how large it will be. We only know that the higher interest rates go in order to slow growth in resource demand to a more sustainable pace the magnitude of shock required to bring a recession diminishes.

Preparing for the next downturn means different things to different businesses. It might mean development of real time information systems and analysis of data in order to identify a turning in sales as soon as it happens. Then appropriate action can be taken.

It might mean using the upturn to broaden one’s profitable product range in order to get some more secure cash inflows when the downturn arrives.

Debt management is the tricky one. Stronger growth in the economy and sales will probably necessitate and allow some increase in debt levels and ratios in order to optimally take advantage of higher customer numbers. But pay close attention to what your financier is saying. If they are in charge of lending you money, they hopefully have experience of downturns and can bring an emotionally absent assessment of your borrowing risk. However, strong economic growth can bring less experienced lenders into play and a few just looking to grow their market share.

From them you won’t necessarily get a professional assessment of the true risks involved in taking on the debt you want. This is where you want to have a relatively burdensome lending authority overseeing what the lenders are doing. While there has just been an easing of bank capital requirements it looks like our lending oversight regime is relatively robust and financial disasters from excessive lending tend these days to be associated with smaller hyped up financing operations rather than the established institutions.

With regard to the state of the economy, here are some of the factors underpinning the common expectation that things will be better this year. Monetary policy has been taken from contractionary into stimulatory territory with the cash rate falling from 5.5% to 2.25% over a 15-month period. Debt servicing costs have fallen for businesses and consumers with more to come as people roll off older slightly higher fixed rates.

The housing cycle has turned upward though no boom is underway or expected this upward leg. The number of properties sold in the three months to November was ahead 3% from a year ago and 20% from two years back. Average prices in the three months to November were ahead 0.1% on a year ago but still down 9% from a year ago. Prices have stopped falling but in recent months have shown some extra strength. More significantly, the number of consents issued for new dwellings to be built around the country was ahead 19% in the three months to October from a year earlier.

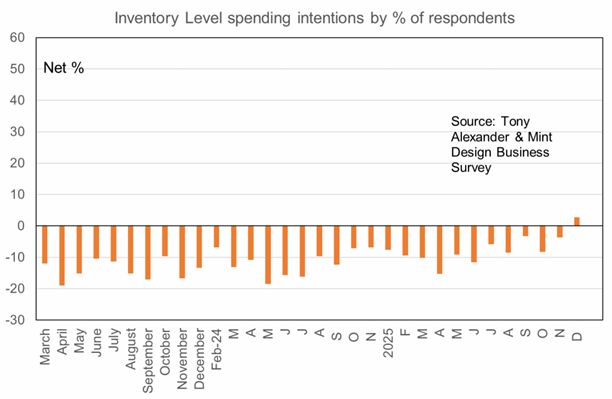

As discussed just below, the business investment cycle is turning upward with capital spending intentions at their highest levels in 11 years. My own business survey with MintHC shows for the first time in almost three years net positive intentions of businesses to grow their inventories.

There is a lot of extra spending to be done on the country’s infrastructure – though this is more of a continuation of what is underway rather than necessarily a big extra GDP boost. As current projects end new ones commence.

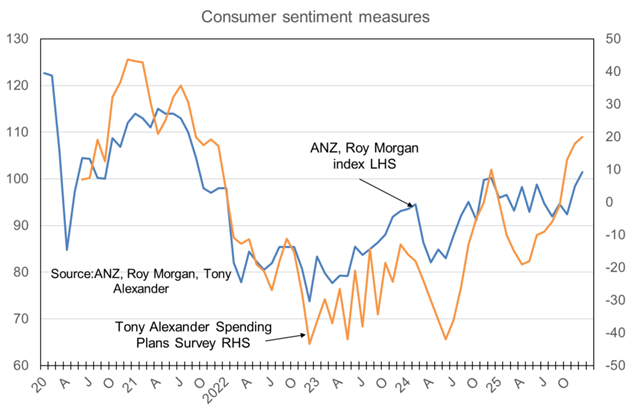

Consumers strongly indicate that they plan spending more with my own Spending Plans Survey showing a net 20% of people plan more buying of things. The ANZ Roy Morgan measure has just reached a four and a half year high.

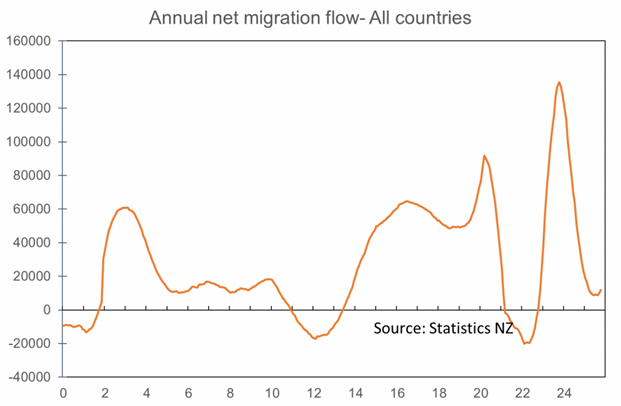

Despite promises to focus on high value clients when the pandemic struck tourist sector operators have quickly reverted to a bulk numbers game and are achieving success. The number of foreign visitors to the country rose 6% in the year to October and at 3.5 million the total is just 12% below the late-2019 peak. There are signs that net migration flows may be turning – but from a low level. The annual net migration gain rose to 11,900 in October from 8,700 in August. It is early days as yet for this factor and it would be unwise to place reliance on any forecast of what lies ahead.

Farm incomes have risen strongly this past year, and this is historically one of the key factors which underpins recovery in the New Zealand economy.

However, recent declines in dairy prices and efforts to reduce high debt levels will tend to constrain the magnitude of this stimulus.

The negatives for the coming year mainly take the form of risks causing consumers and businesses to close their wallets again. Initial media attention may be on offshore risks and uncertainties though often these can get blown out of proportion as a true driver of spending willingness changes here. The big factor here is the general election.

There is considerable angst in the business community regarding the possibility of a return of a Labour dominated government reliant on support from the Greens and Maori Party. These concerns are likely to cause businesses to pause their hiring and investment actions from around the middle of the year.

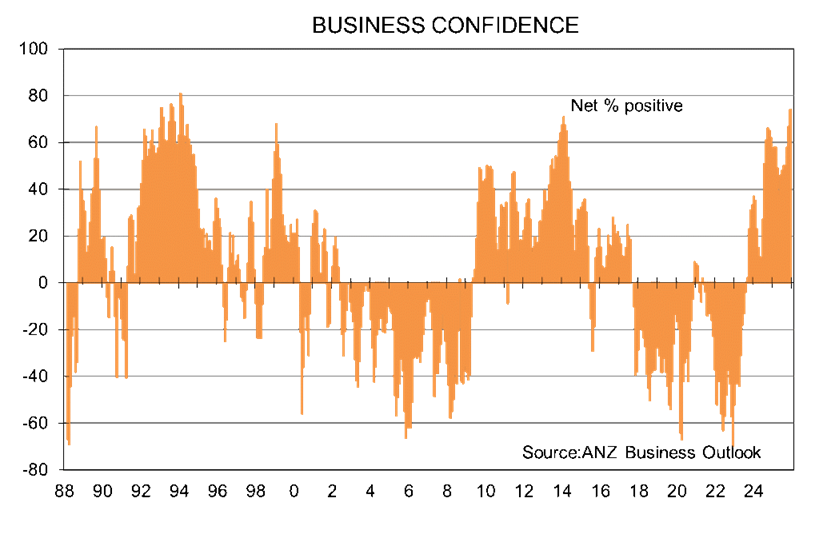

Businesses Happy

Of key importance when it comes to believing that better times lie ahead are the results of the ANZ’s final Business Outlook survey released just ahead of Christmas. They showed a rise in the net proportion of businesses confident about the economy in the year ahead to a very high 74%.

A year ago, this measure was 62% and two years back 33%. The latest result is the strongest since 1994.

The net proportion of businesses planning to boost their capital spending has risen to 28% from 20% in November, and 22% a year ago. The result is the strongest since early-2014. Employment intentions have also firmed to a healthy net 28% positive from 19% in November and 14% a year earlier. The result is the best also since 2014.

These results provide ample reason for believing hiring and investment will pick up this year and drive economic growth forward.

Credit: Tony's View - 8 January 2026: Tony Alexander Economist

Damien Fahey; Partner

Tabak Business Sales, Tauranga